|

|

INTERNATIONAL LONGSHORE AND WAREHOUSE UNION | LOCAL 13 630 South Centre Street | San Pedro, CA 90731 | (310) 830-6116

from your Benefits Office Benefits Bulletin #10-2020

|

OCTOBER 2020 BULLETIN

Sisters and Brothers, as I begin my third term as your Benefits Officer, there is one topic that is weighing very heavily on my mind, so much so that it is the focus of this month’s bulletin. There is a huge problem within our Local of members and retirees not having their affairs in order when they die, leaving their family – who is already grieving their loss – to find out that beneficiary forms are not current and/or the member was not in good standing with the Local. Beneficiary forms are available at the Local 13 Benefits Office and must be submitted in person by the member or retiree. Forms that are emailed or “dropped off” on behalf of members will not be accepted.

What to do when a member or retiree passes away…

1. The first thing that needs to happen is that the NEXT OF KIN must call the Benefits Office to make an Official Notification of Death (OND). This starts the process and gets the ball rolling for the next steps. Only the Benefits Staff can accept an OND. There is a standard form that must be completed. ONDs can be done by telephone or in person, but not by email, text, or social media.

2. Per Local 13’s Constitution, a benefit payment is provided to the beneficiary or beneficiaries of a Class A member or retiree who is in good standing at the time of death. The Benefits Office notifies the Dues Office of the death, and a Member Financial History statement is prepared which includes the balance of any dues, fines, and assessments owed by the deceased member.

3. The Benefits Office then distributes notices to the Benefit Plans Office (BPO) in San Francisco and PMA. Each notice triggers a different process from its respective organization. The BPO does their thing, and PMA does their thing.

4. The Benefits Office then mails a registered letter to whoever is the beneficiary on file requesting that the recipient call the office to schedule a meeting with me. When the meeting is scheduled, beneficiaries are advised that an original certified death certificate is required.

5. During my meeting with the beneficiary or beneficiaries, I discuss a very comprehensive check list of numerous items to assist families in the aftermath of a member or retiree passing away. This is done as a courtesy to guide grieving families as they navigate through an overwhelming process that can be painful and time-consuming.

6. Most meetings run very smoothly, but some meetings can be very difficult because there are unfortunate surprises. For example, the deceased member’s spouse who was expecting to be the beneficiary, actually is not. Imagine the heartbreak when the beneficiary turns out to be an ex-boyfriend or ex-girlfriend going back to when the member was first registered, because beneficiary forms were not updated.

7. There is a life insurance policy which members and retirees have through collective bargaining and which is administered by the BPO. This contractual benefit is completely separate from the Local 13 Benefits Office we have nothing to do with it, however, we do provide instructions and contact information for families of the deceased to follow up directly with the BPO.

8. It takes about 30-45 days for the insurance company to complete their due process and issue payment for both the burial benefit and the insurance policy.

9. To find out how much you owe in dues, fees, and assessments, or to make payment arrangements, please call the Dues Office at (310) 830-1130. The cashiers are Michael Bixler at extension 118 and Steve Flores at extension 126.

10. Insurance premiums are:

|

Member Status |

Life Insurance Policy through Our Contract (for all ILWU Local 13 registered members) |

Burial Benefit from Local 13 (for Class A Members in Good Standing) |

|

Active |

$35,000.00 |

$5,600.00 |

|

Retired |

$7,500.00 |

$1,600.00 |

|

|

This benefit if FREE for ALL members who meet the BPO criteria for eligibility. through collective bargaining. |

This benefit is available to all ACTIVE members. It is OPTIONAL for all RETIREES at the cost of $66 per year which is $5.50 per month. |

(page 1 of 2)

|

At the time of your passing, it is imperative that your family has access to your important information and that they understand your final wishes. These are guidelines to help you get started. It is recommended that you organize originals and copies of the most current of each of the following in separate, clearly labeled files: |

|

Personal Information

- Full legal name, and date/place of birth

- Driver’s license, passport, social security number

- Names and contact information of spouse and children

- Birth and death certificates, and certificates of marriage, divorce, citizenship, and adoption

- Employers and dates of employment

- Education and military records

- Memberships in groups and awards received

- Names and phone numbers of close friends, relatives, doctors, lawyers, and financial advisors

Financial Records

- Sources of income and assets (pension from your employer, IRAs, 401(k)s, interest, etc.)

- Title, deed, or trust to property, and mortgage statement

- Social Security and Medicare/Medicaid information

- Insurance information (life, health, long-term care, home, car) with policy numbers and agents’ names and phone numbers

- Names of your banks and account numbers (checking, savings, credit union)

- Investment income (stocks, bonds, property) and stockbrokers’ names and phone numbers

- Most recent income tax returns

- Location of most up-to-date will with an original signature

- Liabilities, including property tax— what is owed, to whom, and when payments are due

- Bills, debts, utilities —how and when they are paid

- Car title and registration

- Credit and debit card names and numbers

- Location of safe deposit box and key

- Legal documents such as Power of Attorney (general or durable)

|

Medical Plan |

Final Arrangements |

|

· Medications and prescription · Providers’ contact information · Advanced care/hospice directive |

· Contact information for clergy · Burial/cremation/funeral/memorial plan · Obituary |

|

In service to our local, our union, and our community.

Vivian Malauulu, M.A. Benefits Officer

Benefits Bulletin #10-2020 OPEIU #537/MV |

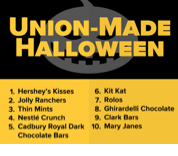

This Halloween, don’t settle for a TRICK! Make sure your candy selection is a union-made TREAT!

|